Business Insurance in and around Saint Louis

One of Saint Louis’s top choices for small business insurance.

Cover all the bases for your small business

- Oakville

- South County

- Mehlville

- St. Louis

- St. Louis County

- Jefferson County

- Affton

- St. Louis City

- Arnold

- 63129

- 63123

- 63116

- 63010

- 63128

- Crestwood

- Lemay

- Saint Louis

- Saint Louis County

- STL

- Fenton

- 63126

- Florissant

- Festus

- High Ridge

Business Insurance At A Great Value!

Whether you own a a cosmetic store, an art gallery, or a home improvement store, State Farm has small business protection that can help. That way, amid all the different options and decisions, you can focus on making this adventure a success.

One of Saint Louis’s top choices for small business insurance.

Cover all the bases for your small business

Protect Your Business With State Farm

When one is as driven about their small business as you are, it is understandable to want to make sure all systems are a go. That's why State Farm has coverage options for worker’s compensation, commercial liability umbrella policies, commercial auto, and more.

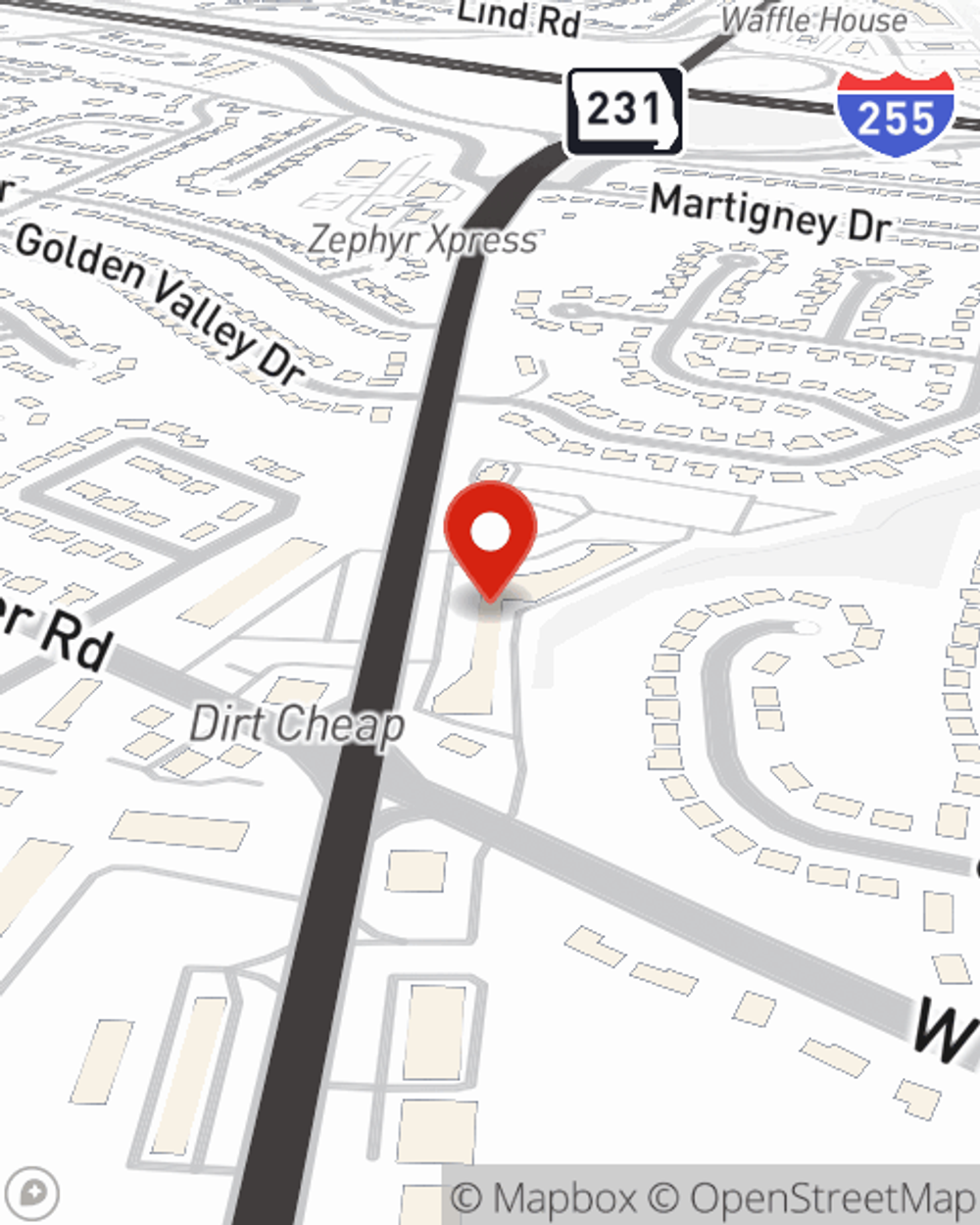

The right coverages can help keep your business safe. Consider stopping by State Farm agent Dan Rataj's office today to review your options and get started!

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Dan Rataj

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.